Article written by Lou Vlahos of FarrellFritz Attorneys, used with their written permission.

The Joy – and Tax Benefits – of Gifting

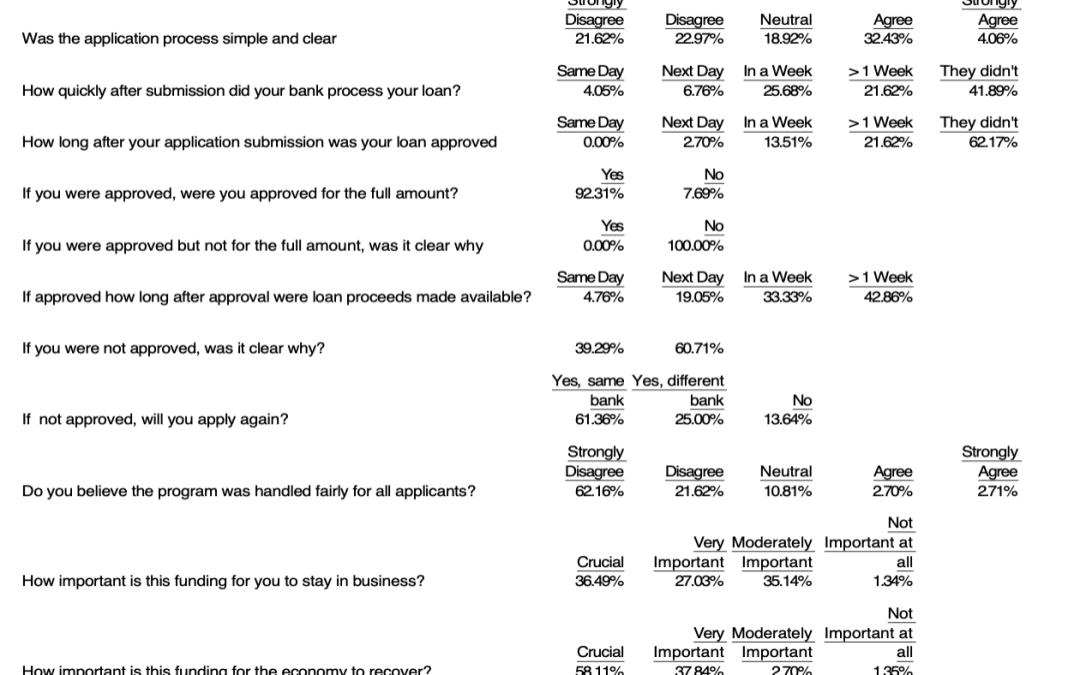

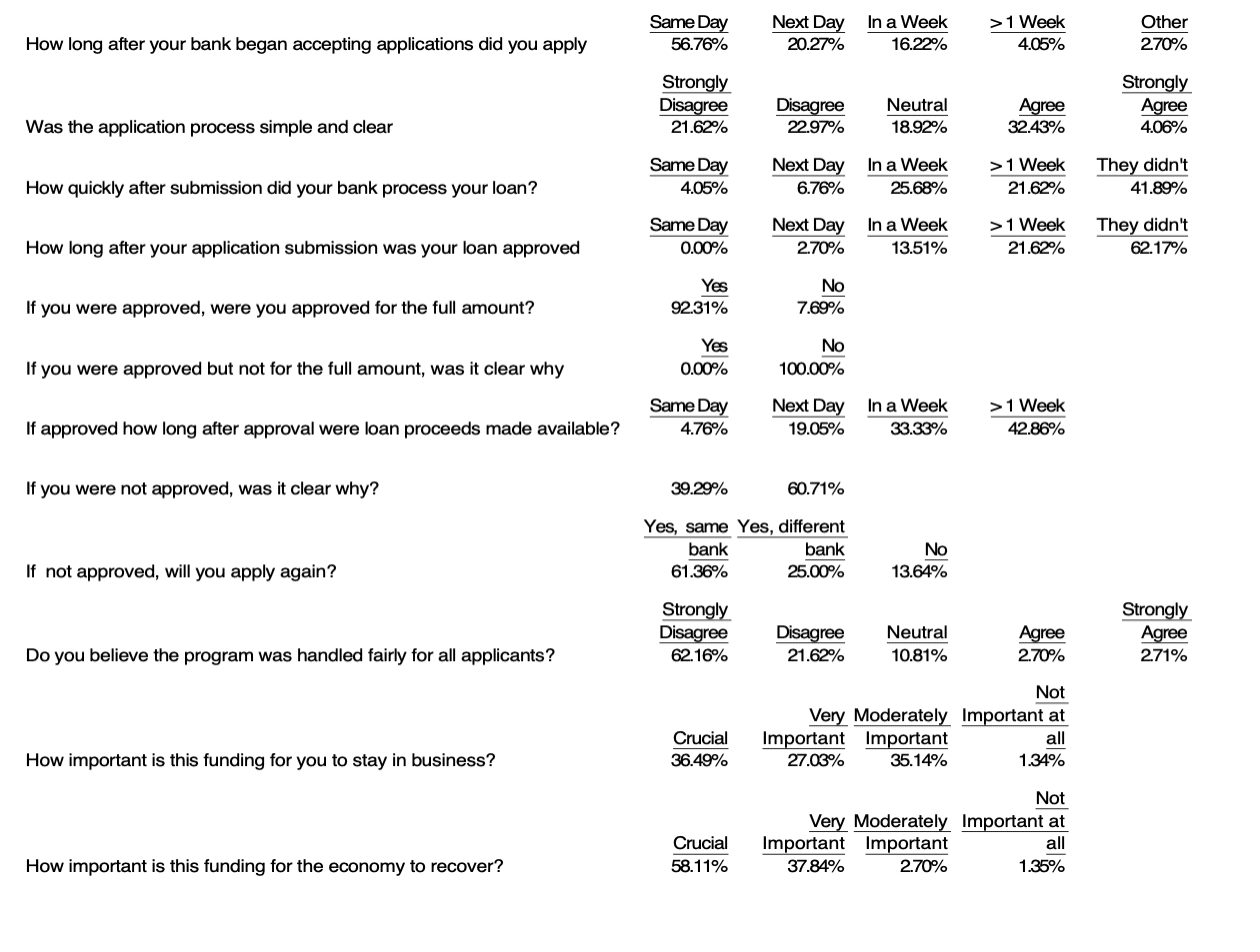

As we enter the “season of giving” and the end of yet another year, the thoughts of many tax advisers turn to . . . tax planning.(i) In keeping with the spirit of the season, an adviser may suggest that a client with a closely held business consider making a gift of equity in the business to the owner’s family or to a trust for their benefit.(ii)

As we enter the “season of giving” and the end of yet another year, the thoughts of many tax advisers turn to . . . tax planning.(i) In keeping with the spirit of the season, an adviser may suggest that a client with a closely held business consider making a gift of equity in the business to the owner’s family or to a trust for their benefit.(ii)

Of course, annual exclusion gifts(iii) are standard fare and, over the course of several years, may result in the transfer of a not insignificant portion of the equity in a business.

However, the adviser may also recommend that the client consider making larger gifts, thereby utilizing a portion of their “unified” gift-and-estate tax exemption amount during their lifetime. Such a gift, the adviser will explain, may remove from the owner’s gross estate not only the current value of the transferred business interests, but also the future appreciation thereon.(iv)

The client and the adviser may then discuss the “size” of the gift and the valuation of the business interests to be gifted, including the application of discounts for lack of control and lack of marketability. At this point, the adviser may have to curb the client’s enthusiasm somewhat by reminding them that the IRS is still skeptical of certain valuation discounts, and that an adjustment in the valuation of a gifted business interest may result in a gift tax liability.

The key, the adviser will continue, is to remove as much value from the reach of the estate tax as reasonably possible, and without incurring a gift tax liability – by utilizing the client’s remaining exemption amount – while also leaving a portion of such exemption amount as a “cushion” in the event the IRS successfully challenges the client’s valuation.

“Ask and Ye Shall Receive”(v)

Enter the 2017 Tax Cuts and Jobs Act (the “Act”).(vi) Call it an early present for the 2018 gifting season.

One of the key features of the Act was the doubling of the federal estate and gift tax exemption for U.S. decedents dying, and for gifts made by U.S. individuals,(vii) after December 31, 2017, and before January 1, 2026.

This was accomplished by increasing the basic exemption amount (“BEA”) from $5 million to $10 million. Because the exemption amount is indexed for inflation (beginning with 2012), this provision resulted in an exemption amount of $11.18 million for 2018, and this amount will be increased to $11.4 million in 2019.(viii)

Exemption Amount in a Unified System

You will recall that the exemption amount is available with respect to taxable transfers made by an individual taxpayer either during their life (by gift) or at their death – in other words, the gift tax and the estate tax share a common exemption amount.(x)

The gift tax is imposed upon the taxable gifts made by an individual taxpayer during the taxable year (the “current taxable year”). The gift tax for the current taxable year is determined by: (1) computing a “total tentative tax” on the combined amount of all taxable gifts made by the taxpayer for the current and all prior years using the common gift tax and estate tax rate table; (2) computing a tentative tax only on all prior-year gifts; (3) subtracting the tentative tax on prior-year gifts from the tentative tax computed for all years to arrive at the portion of the total tentative tax attributable to current-year gifts; and, finally, (4) subtracting the amount of the taxpayer’s unified credit (derived from the unused exemption amount) not consumed by prior-year gifts.

Thus, taxable gift transfers(xi) that do not exceed a taxpayer’s exemption amount are not subject to gift tax. However, any part of the taxpayer’s exemption amount that is used during their life to offset taxable gifts reduces the amount of exemption that remains available at their death to offset the value of their taxable estate.(xii)

From a mechanical perspective, this “unified” relationship between the two taxes is expressed as follows:

• the deceased taxpayer’s taxable estate is combined with the value of any taxable gifts made by the taxpayer during their life;

• the estate tax rate is then applied to determine a “tentative” estate tax;

• the portion of this tentative estate tax that is attributable to lifetime gifts made by the deceased taxpayer is then subtracted from the tentative estate tax to determine the “gross estate tax” – i.e., the amount of estate tax before considering available credits, the most important of which is the so-called “unified credit”; and

• credits are subtracted to determine the estate tax liability.

This method of computation is designed to ensure that a taxpayer only gets one run up through the rate brackets for all lifetime gifts and transfers at death.(xiii)

What Happens After 2025?(xvi)

However, given the temporary nature of the increased exemption amount provided by the Act, many advisers questioned whether the cumulative nature of the gift and estate tax computations, as described above, would result in inconsistent tax treatment, or even double taxation, of certain transfers.

To its credit,(xv) Congress foresaw some of these issues and directed the IRS to prescribe regulations regarding the computation of the estate tax that would address any differences between the exemption amounts in effect: (i) at the time of a taxpayer’s death and (ii) at the time of any gifts made by the taxpayer.

Pending the issuance of this guidance – and pending the confirmation of what many advisers believed was an expression of Congressional intent not to punish individuals who make gifts using the increased exemption amount – many taxpayers decided not to take immediate advantage of the greatly increased exemption amount, lest they suffer any of the consequences referred to above.

Proposed Regulations

In response to Congress’s directive, however, the IRS proposed regulations last week that should allay the concerns of most taxpayers,(xvi) which in turn should smooth the way to increased gifting and other transfers that involve an initial or partial gift.

In describing the proposed regulations, the IRS identified and analyzed several situations that could have created unintended problems for a taxpayer, though it concluded that the existing methodology for determining the taxpayer’s gift and estate tax liabilities provided adequate protection against such problems:

• Whether a taxpayer’s post-2017 increased exemption amount would be reduced by pre-2018 gifts on which gift tax was paid. If the taxpayer makes additional gifts during the post-2017 increased exemption period, would the gift tax computation apply the increased exemption to the pre-2018 gifts, thus reducing the exemption otherwise available to shelter gifts made during the post-2017 period, effectively allocating credit to a gift on which gift tax in fact was already paid, and denying the taxpayer the full benefit of the increased exemption amount for transfers made during the increased exemption period?

• Whether the increased exemption amount available during the increased exemption period would be reduced by pre-2018 gifts on which gift tax was paid. If the taxpayer died during the increased exemption period, would the estate tax computation apply the increased exemption to the pre-2018 gifts, thus reducing the exemption otherwise available against the estate tax during the increased exemption period and, in effect, allocating credit to a gift on which gift tax was paid?

• Whether the gift tax on a post-2025 transfer would be inflated by the theoretical gift tax on a gift made during the increased exemption period that was sheltered from gift tax when made. Would the gift tax determination on the post-2025 gift treat the gifts made during the increased exemption period as gifts that were not sheltered from gift tax given that the post-2025 gift tax determination is based on the exemption amount then in effect, rather than on the increased exemption amount, thereby increasing the gift on the later transfer and effectively subjecting the earlier gift to tax even though it was exempt from gift tax when made?

With respect to the first two situations described above, the IRS determined that the current methodology by which a taxpayer’s gift and estate tax liabilities are determined ensures that the increased exemption will not be reduced by a prior gift on which gift tax was paid. As to the third situation, the IRS concluded that the current methodology ensures that the tax on the current gift will not be improperly inflated.

New Regulations

However, there was one situation in which the IRS concluded that the methodology for computing the estate tax would, in effect, retroactively eliminate the benefit of the increased exemption that was available for gifts made during the increased exemption period.

Specifically, the IRS considered whether, for estate tax purposes, a gift made by a taxpayer during the increased exemption period, and that was sheltered from gift tax by the increased exemption available during such period, would inflate the taxpayer’s post-2025 estate tax liability.

The IRS determined that this result would follow if the estate tax computation failed to treat such gifts as sheltered from gift tax.

Under the current methodology, the estate tax computation treats the gifts made during the increased exemption period as taxable gifts not sheltered from gift tax by the increased exemption amount, given that the post-2025 estate tax computation is based on the exemption in effect at the decedent’s death rather than the exemption in effect on the date of the gifts.

For example, if a taxpayer made a gift of $11 million in 2018, (when the BEA is $10 million; a taxable gift of $1 million), then dies in 2026 with a taxable estate of $4 million (when the BEA is $5 million), the federal estate tax would be approximately $3,600,000: 40% estate tax on $9 million – specifically, the sum of the $4 million taxable estate plus $5 million of the 2018 gift that was sheltered from gift tax by the increased exemption. This, in effect, would impose estate tax on the portion of the 2018 gift that was sheltered from gift tax by the increased exemption allowable at that time.

Alternatively, what if the taxpayer dies in 2026 with no taxable estate? The taxpayer’s estate tax would be approximately $2 million, which is equal to a 40% tax on $5 million – the amount by which, after taking into account the $1 million portion of the 2018 gift on which gift tax was paid, the 2018 gift exceeded the BEA at death. This, in effect, would impose estate tax on the portion of the 2018 gift that was sheltered from the gift tax by the excess of the 2018 exemption over the 2026 exemption.

The IRS determined that this problem arises from the interplay between the differing exemption amounts that are taken into account in the computation of the estate tax.

Specifically, after first determining the tentative tax on the sum of a decedent’s taxable estate and their adjusted taxable gifts,(xvii)

i. the decedent’s estate must then determine the credit against gift taxes for all prior taxable gifts, using the exemption amount allowable on the dates of the gifts (the credit itself is determined using date of death tax rates);

ii. the gift tax payable is then subtracted from the tentative tax, the result being the net tentative estate tax; and

iii. the estate next determines a credit based on the exemption amount as in effect on the date of the decedent’s death, which is then applied to reduce the net tentative estate tax.

If this credit (based on the exemption amount at the date of death) is less than the credit allowable for the decedent’s taxable gifts (using the date of gift exemption amount), the effect is to increase the estate tax by the difference between the two credit amounts.

In this circumstance, the statutory requirements for computing the estate tax have the effect of imposing an estate tax on gifts made during the increased exemption period that were sheltered from gift tax by the increased exemption amount in effect when the gifts were made.

In order to address this unintended result, the proposed regulations would add a special computation rule in cases where (i) the portion of the credit as of the decedent’s date of death that is based on the exemption is less than (ii) the sum of the credits attributable to the exemption allowable in computing the gift tax payable. In that case, the portion of the credit against the net tentative estate tax that is attributable to the exemption amount would be based upon the greater of those two credit amounts.

Specifically, if the total amount allowable as a credit, to the extent based solely on the BEA, in computing the gift tax payable on the decedent’s post-1976 taxable gifts, exceeds the credit amount based solely on the BEA in effect at the date of death, the credit against the net tentative estate tax would be based on the larger BEA.

For example, if a decedent made cumulative taxable gifts of $9 million, all of which were sheltered from gift tax by a BEA of $10 million applicable on the dates of the gifts,(xviii) and if the decedent died after 2025 when the BEA was $5 million, the credit to be applied in computing the estate tax would be based upon the $9 million of exemption amount that was used to compute the gift tax payable.

Time to Act?

By addressing the unintended results presented in the situation described – a gift made the decedent during the increased exemption period, followed by the death of the decedent after the end of such period – the proposed regulations ensure that the decedent’s estate will not be inappropriately taxed with respect to the gift.

With this “certainty,” an individual business owner who has been thinking about gifting a substantial interest in their business may want to accelerate their gift planning. As an additional incentive, the owner need only look at the results of the mid-term elections, which do not bode well for the future of the increased exemption amount. In other words, it may behoove the owner to treat 2020 (rather than 2025) as the final year for which the increased exemption amount will be available, and to plan accordingly. Those owners who decide to take advantage of the increased exemption amount by making gifts should consider how they may best leverage it.

And as always, tax savings, estate planning, and gifting strategies have to be considered in light of what is best for the business and what the owner is comfortable giving up.

—————————————————————

(i) What? Did you really expect something else? Tax planning is not a seasonal exercise – it is something to be considered every day, similar to many other business decisions.

(ii) Of course, the interest to be gifted should be “disposable” in that the owner can comfortably afford to give up the interest. Even if that is the case, the owner may still want to consider the retention of certain “tax-favored” economic rights with respect to the interest so as to reduce the amount of the gift for tax purposes.

(iii) Usually into an irrevocable trust, and coupled with the granting of “Crummey powers” to the beneficiaries so as to support the gift as one of a “present interest” in property. A donor’s annual exclusion amount is set at $15,000 per donee for 2018 and $15,000 for 2019.

(iv) In other words, a dollar removed today will remove that dollar plus the appreciation on that dollar; a dollar at death shields only that dollar.

The removal of this value from the reach of the estate tax has to be weighed against the loss of the stepped-up basis that the beneficiaries of the decedent’s estate would otherwise enjoy if the gifted business interest were included in the decedent’s gross estate.

(v) Matthew 7:7-8. Actually, many folks asked for the repeal of the estate tax. “You Can’t Always Get What You Want,” The Rolling Stones.

(vi) P.L. 115-97.

(vii) For purposes of the estate tax, this includes a U.S. citizen or domiciliary. The distinction between a U.S. individual and non-resident-non-citizen is significant. In the absence of any estate and gift tax treaty between the U.S and the foreign individual’s country, the foreign individual is not granted any exclusion amount for purposes of determining their U.S. gift tax liability, and only a $60,000 exclusion amount for U.S. estate tax purposes.

(viii) https://www.irs.gov/pub/irs-drop/rp-18-57.pdf

(ix) Only individual transferors are subject to the gift tax. Thus, in the case of a transfer from a business entity that is treated as a gift, one or more of the owners of the business entity will be treated as having made the gift.

(x) They also share a common tax rate table.

(xi) As distinguished, for example, from the annual exclusion gift – set at $15,000 per donee for 2018 and for 2019 – which is not treated as a taxable gift (it is not counted against the exemption amount).

(xii) An election is available under which the federal exemption amount that was not used by a decedent during their life or at their death may be used by the decedent’s surviving spouse (“portability”) during such spouse’s life or death.

(xiii) A similar approach is followed in determining the gift tax, which is imposed on an individual’s transfers by gift during each calendar year.

(xiv) As indicated above, the increased exemption amount is scheduled to sunset after 2025, at which point the lower, pre-TCJA basic exclusion amount is reinstated, as adjusted for inflation through 2025. Of course, a change in Washington after 2020 could accelerate a reduction in the exemption amount.

(xv) I bet you don’t hear that much these days.

(xvi) https://www.federalregister.gov/documents/2018/11/23/2018-25538/estate-and-gift-taxes-difference-in-the-basic-exclusion-amount; the regulations are proposed to be effective on and after the date they are published as final regulations in the Federal Register.

(xvii) Defined as all taxable gifts made after 1976 other than those included in the gross estate.

(xviii) Post-TCJA and before 2026.

professionals working with small businesses have stories they hear from clients about bad situations that could have been avoided. Here are two that we’ve heard from our clients:

professionals working with small businesses have stories they hear from clients about bad situations that could have been avoided. Here are two that we’ve heard from our clients: