You’re inundated with a deluge of articles and guidance emphasizing the urgency of transferring your assets out of your estate now. Your failure to do so might result in significant tax liabilities.

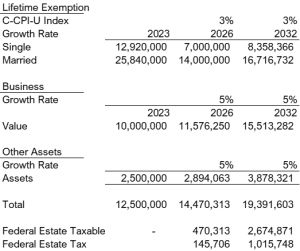

The U.S. government has introduced an unprecedented historical gift tax exemption, allowing individuals to gift assets up to $12.92 million individually or jointly with their spouse, totaling $25.84 million. This exemption amount increases annually in line with the Chained Consumer Price Index.

However, this exceptionally high exemption is set to expire in 2025, after which it will decrease to an estimated range of $6 million to $8 million, depending on factors such as inflation.

You’ve likely read this estate tax exemption is a point of contention between Democrats and Republicans. Democrats aim to eliminate it, while Republicans seek to extend it. This perpetual political battle adds another layer of uncertainty.

What does all of this mean for you? It’s nearly impossible to provide an exact answer, so I’ve devised a hypothetical scenario to illustrate the potential impact.

Suppose your business is presently valued at $10 million, and your other assets (investments, residences, etc.) amount to around $2.5 million, with both appreciating by 5% annually. This example assumes you are married and have not utilized any of your lifetime exemption. The scenario calculates potential taxes at the later of your and your spouse’s date of passing. Current federal regulations allow for the tax-free transfer of assets between spouses. Estate taxes may apply if assets are bequeathed to children or other beneficiaries upon your demise.

Note that this example does not consider state estate taxes, because they vary widely. Some states do not acknowledge gifts, while others impose no estate taxes at all. Additionally, some states may not permit a spousal exemption, making it essential to consult your professional advisors for tailored guidance.

Let’s explore the potential tax consequences of this scenario. I’ve ended the projection in 2032 simply as a placeholder. The longer you and your spouse live, the greater the potential estate tax liabilities. The tax rates utilized are current as of 2023 and are subject to change.

Gifting assets does not need to lead to a reduction in your income. Your professional advisor is best equipped to devise a plan that preserves your income while addressing these tax considerations.